This card is designed to reward loyal shoppers with exclusive benefits, including cashback rewards, special discounts, and access to members-only events. Whether you’re an avid hunter, angler, or camper, this card offers a unique opportunity to maximize your spending while indulging in your passion for the outdoors. With its user-friendly features and tailored perks, it’s no wonder that Cabela's credit card has become a popular choice among outdoor enthusiasts. For those unfamiliar with Cabela's, it’s a well-known retailer specializing in outdoor recreation merchandise, offering everything from hunting gear to camping essentials. The Cabela's credit card is a strategic tool that enhances the shopping experience by providing financial flexibility and rewarding customer loyalty. With no annual fee and the ability to earn points on every purchase, this card is designed to make your outdoor adventures more affordable and enjoyable. By understanding the ins and outs of this card, you can make an informed decision about whether it aligns with your financial goals and lifestyle. In this article, we’ll delve into the specifics of Cabela's credit card, exploring its benefits, rewards structure, application process, and more. We’ll also address common questions and concerns to help you determine if this card is the right fit for you. From its unique rewards program to its practical everyday use, we’ll cover everything you need to know to make the most of this financial tool. By the end of this guide, you’ll have a comprehensive understanding of how Cabela's credit card can enhance your shopping experience while supporting your outdoor lifestyle.

Table of Contents

- What Are the Benefits of Cabela's Credit Card?

- How Does Cabela's Credit Card Rewards Program Work?

- Is Cabela's Credit Card Worth It for Outdoor Enthusiasts?

- How to Apply for Cabela's Credit Card

- What Are the Eligibility Requirements for Cabela's Credit Card?

- How to Maximize Your Rewards with Cabela's Credit Card

- What Are the Terms and Conditions of Cabela's Credit Card?

- Frequently Asked Questions About Cabela's Credit Card

What Are the Benefits of Cabela's Credit Card?

Cabela's credit card comes packed with a variety of benefits that make it a standout option for outdoor enthusiasts. One of the most appealing features is the rewards program, which allows cardholders to earn points on every purchase. These points can be redeemed for Cabela's CLUB points, which are essentially store credit that can be used to buy gear, apparel, and other outdoor essentials. The more you shop, the more rewards you earn, making it a great way to save money while fueling your passion for the outdoors.

Another significant advantage is the exclusive access to members-only events and promotions. Cardholders often receive early access to sales, special discounts, and even invitations to private events hosted by Cabela's. These perks not only enhance the shopping experience but also provide opportunities to snag high-demand items at reduced prices. Additionally, the card offers a 10% discount on your first day of purchases when you sign up, giving you an immediate incentive to start using the card right away.

Read also:Nba Star Wilkins Finds Love Again A Heartwarming Tale Of Resilience

For those who value convenience, the Cabela's credit card is easy to use both online and in-store. There’s no annual fee, which makes it an affordable option for budget-conscious shoppers. The card also offers flexible payment options, allowing you to manage your spending without feeling overwhelmed. Whether you’re purchasing a new fishing rod, camping equipment, or hunting gear, this card provides a seamless way to finance your outdoor adventures while earning rewards along the way.

How Does Cabela's Credit Card Rewards Program Work?

The rewards program associated with Cabela's credit card is designed to incentivize frequent shopping while offering tangible benefits. Every time you make a purchase using the card, you earn points that accumulate in your account. These points are then converted into Cabela's CLUB points, which function as store credit. For example, if you spend $100 on outdoor gear, you’ll earn a certain number of points that can later be redeemed for discounts on future purchases. This system encourages cardholders to keep coming back, knowing they’re earning value with every transaction.

One of the standout features of the rewards program is its tiered structure. The more you spend, the higher your rewards rate becomes. For instance, spending within specific thresholds can unlock bonus points or higher redemption values. This tiered approach ensures that loyal customers are rewarded generously for their continued patronage. Additionally, cardholders can combine their CLUB points with other promotions, such as seasonal sales, to maximize their savings. This flexibility makes the rewards program particularly appealing to frequent shoppers.

Another aspect worth noting is the ease of tracking your rewards. The Cabela's credit card offers an online portal where users can monitor their points balance, view redemption options, and even track their spending. This transparency allows cardholders to stay informed about their rewards progress and plan their purchases accordingly. By understanding how the rewards program works, you can strategically use your card to maximize benefits and make the most of your outdoor shopping experience.

Is Cabela's Credit Card Worth It for Outdoor Enthusiasts?

If you’re passionate about outdoor activities like hunting, fishing, or camping, the Cabela's credit card could be a valuable addition to your financial toolkit. The card’s rewards program is specifically tailored to outdoor enthusiasts, offering points that can be redeemed for gear and equipment you’re likely to purchase anyway. This makes it a practical choice for those who frequently shop at Cabela's or other outdoor retailers. The ability to earn rewards while investing in your hobbies is a significant advantage that sets this card apart from generic credit cards.

Beyond the rewards, the card offers exclusive perks that cater to outdoor enthusiasts. For example, cardholders often receive invitations to special events, such as product demos or outdoor workshops, which provide opportunities to learn new skills and connect with like-minded individuals. Additionally, the card’s lack of an annual fee ensures that you can enjoy these benefits without incurring extra costs. This affordability makes it an attractive option for budget-conscious shoppers who want to make the most of their spending.

Read also:Aj Hawk Net Worth 2023 A Dive Into The Life And Wealth Of The Former Nfl Star

However, it’s important to consider whether your shopping habits align with the card’s offerings. If you rarely shop at Cabela's or don’t spend much on outdoor gear, the rewards may not be as impactful. On the other hand, if you’re a frequent shopper who values convenience and savings, this card can significantly enhance your shopping experience. By weighing the pros and cons, you can determine whether the Cabela's credit card is worth it for your lifestyle and financial goals.

How to Apply for Cabela's Credit Card

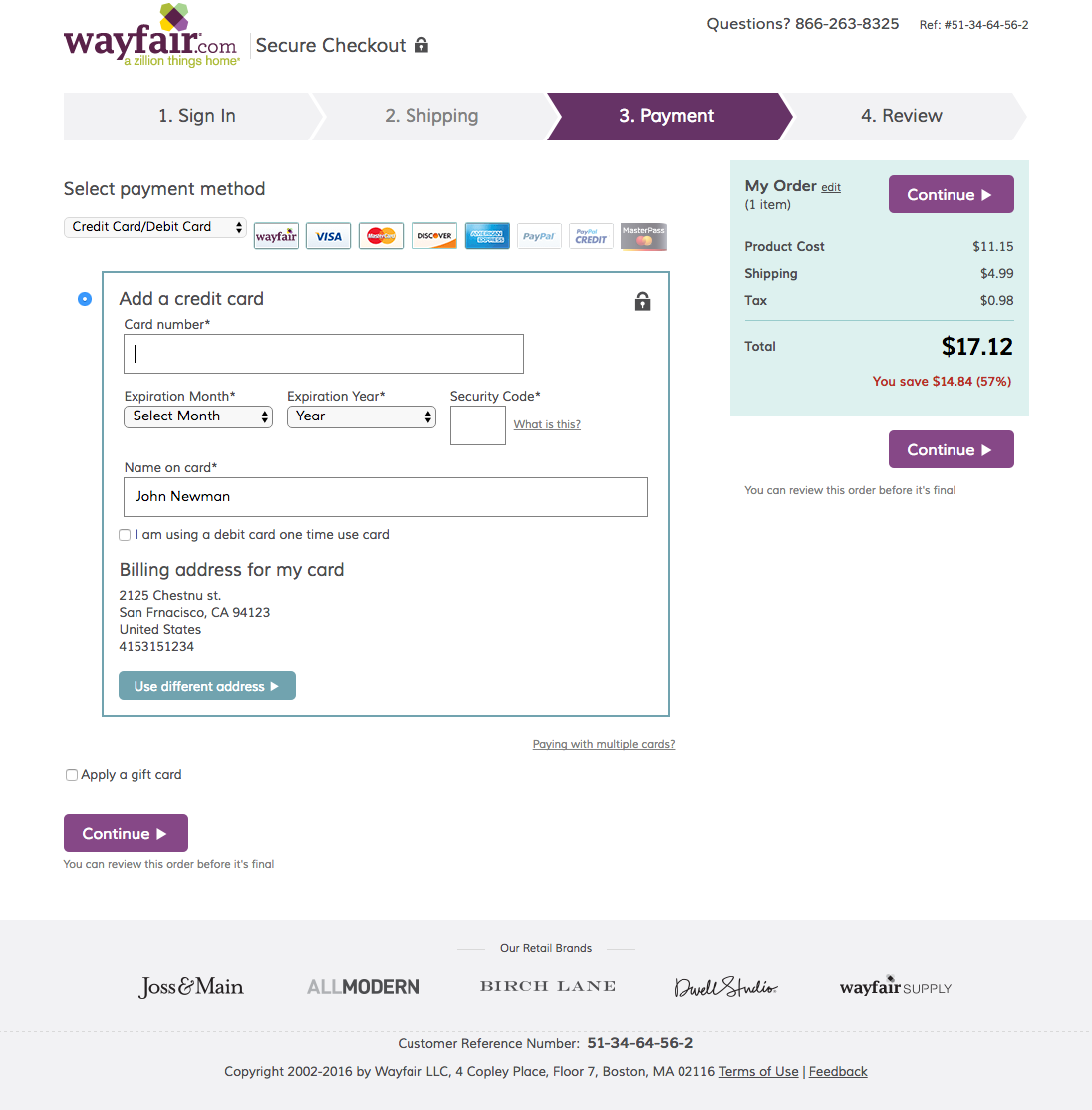

Applying for the Cabela's credit card is a straightforward process that can be completed either online or in-store. To begin, visit the official Cabela's website and navigate to the credit card application page. Here, you’ll find a simple form that requires basic personal information, such as your name, address, and income. The application process is designed to be quick and user-friendly, ensuring that you can complete it in just a few minutes.

What Information Do You Need to Apply?

Before starting the application, gather the necessary documents to streamline the process. You’ll need your Social Security number, proof of income, and contact details. Additionally, having your current employment information on hand can help speed up the verification process. Providing accurate information is crucial, as any discrepancies could delay your application or result in rejection.

What Happens After You Submit Your Application?

Once you’ve submitted your application, it typically takes a few business days for the issuer to review your information. If approved, you’ll receive your card in the mail within 7-10 business days. During this time, you can monitor the status of your application online to stay updated on its progress. Upon receiving your card, activate it by following the instructions provided, and you’ll be ready to start earning rewards on your outdoor purchases.

What Are the Eligibility Requirements for Cabela's Credit Card?

Before applying for the Cabela's credit card, it’s important to understand the eligibility requirements to ensure you qualify. The card issuer typically looks for applicants with a fair to good credit score, which generally falls within the range of 650 to 749. While there’s no strict minimum income requirement, having a stable source of income is essential to demonstrate your ability to manage payments responsibly.

How Does Credit History Impact Eligibility?

Your credit history plays a significant role in the approval process. Lenders review your credit report to assess your financial behavior, including your payment history, outstanding debts, and credit utilization ratio. A clean credit history with no late payments or defaults increases your chances of approval. If your credit score is on the lower end, consider taking steps to improve it before applying, such as paying down existing debts or disputing errors on your credit report.

Are There Age and Residency Requirements?

In addition to credit score and income, applicants must meet age and residency criteria. You must be at least 18 years old and a legal resident of the United States to apply. Non-residents or individuals with limited credit history may face challenges in getting approved. By ensuring you meet these basic requirements, you can increase your likelihood of successfully obtaining the Cabela's credit card and enjoying its benefits.

How to Maximize Your Rewards with Cabela's Credit Card

To get the most out of your Cabela's credit card, it’s essential to adopt strategies that maximize your rewards. One effective approach is to use the card for all your outdoor-related purchases, as these transactions earn points that can be redeemed for CLUB points. By consolidating your spending on this card, you’ll accumulate rewards faster and unlock higher tiers in the rewards program. Additionally, take advantage of promotional periods when bonus points are offered, as these can significantly boost your earnings.

Another way to maximize your rewards is by combining them with other discounts or sales. For example, if Cabela's is running a seasonal sale, use your card to make purchases and then apply your CLUB points for additional savings. This dual-layered approach allows you to stretch your budget further while still enjoying the benefits of the card. It’s also a good idea to regularly review your rewards balance and redemption options to ensure you’re using your points efficiently.

Lastly, stay informed about exclusive cardholder events and promotions. These opportunities often provide additional ways to earn points or save money, such as early access to sales or special discounts on select items. By staying engaged with the card’s offerings and planning your purchases strategically, you can make the most of the Cabela's credit card and enjoy a more rewarding shopping experience.

What Are the Terms and Conditions of Cabela's Credit Card?

Understanding the terms and conditions of the Cabela's credit card is crucial to using it responsibly and avoiding unexpected fees. One of the most appealing aspects of this card is the absence of an annual fee, which makes it an affordable option for many shoppers. However, it’s important to be aware of other potential charges, such as late payment fees or interest rates on unpaid balances. These fees can add up quickly if you’re not diligent about managing your account.

The card’s interest rate, or APR, is another key factor to consider. While the exact rate may vary based on your creditworthiness, it’s typically competitive with other retail credit cards. If you plan to carry a balance, be sure to calculate the potential interest costs to avoid surprises. Additionally, the card issuer may impose penalties for exceeding your credit limit or making late payments, so it’s essential to stay within your limit and pay your bill on time to maintain a good credit standing.

Finally, familiarize yourself with the card’s redemption policies for CLUB points. While points generally don’t expire as long as your account remains active, there may be restrictions on how and when you can redeem them. For example, certain items or promotions may be excluded from point redemptions. By reading the fine print and understanding the terms and conditions, you can use your Cabela's